Digital Transformation for a Leading Healthcare Insurance Provider

Client Overview

Our client, a leading healthcare insurance provider based in Australia, faced significant operational challenges due to the absence of a centralized online customer portal. The provider offers comprehensive health insurance plans, including policy management, claims processing, and approvals, requiring a seamless, efficient, and scalable system for customer interactions.

Business Challenge

The client struggled with:

1. Manual Claims Processing

- Customers submit claims via phone, email, or paper forms, causing delays and errors.

- Difficulty in tracking claim status and approval progress.

2. Inefficient Premium Management & Payment Delays

- Customers struggle to access invoices and track pending premium payments.

- Manual invoicing increases processing time and errors.

- Slow payment collection due to lack of automated reminders and online payment options.

3. Lack of Policy Transparency

- Customers cannot track their policy details, coverage limits, or renewal dates.

- Increased workload on support teams due to frequent customer inquiries.

4. Approval Bottlenecks

- Manual approval processes (e.g., policy changes, pre-approvals for medical procedures) slow down service delivery.

- Delays in approvals impact customer satisfaction and operational efficiency.

5. Limited Communication & Notifications

- No automated updates on claim status, premium due dates, or policy renewal reminders.

- Customers rely on manual follow-ups, leading to frustration and inefficiencies.

6. High Customer Support Workload

- Staff spends excessive time handling inquiries related to claims, invoices, and policy statuses.

- Increased operational costs due to higher customer service demands.

7. Compliance & Record-Keeping Challenges

- Difficulty maintaining accurate records for regulatory compliance.

- Increased risk of data errors and mismanagement without a centralized system.

8. Scalability Issues

- Managing customer interactions manually becomes unsustainable as the business grows.

- Lack of automation limits the provider’s ability to handle a larger customer base efficiently.

Our Approach

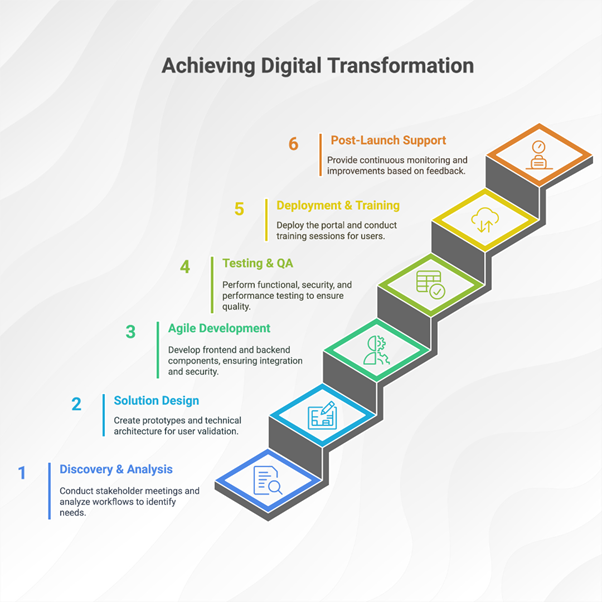

At 42Signs Infosystems, we follow a structured, agile, and customer-centric approach to ensure that the customer portal aligns with the healthcare insurance provider’s specific needs, enhances operational efficiency, and delivers an intuitive user experience. Our methodology ensures seamless integration, security, scalability, and long-term success.

1️. Discovery & Requirement Analysis

- Conduct in-depth stakeholder meetings with the provider’s leadership, IT team, and customer service representatives.

- Analyze existing workflows (claims processing, premium payments, policy management, approvals, notifications).

- Identify key integrations required with existing ERP, CRM, payment gateways, and regulatory compliance systems.

- Define key user personas: policyholders, corporate clients, internal teams, and administrators.

2️. Solution Design & Prototyping

- Design high-fidelity wireframes and interactive prototypes using Figma / Adobe XD for user validation.

- Create a technical architecture ensuring modularity, scalability, and security.

- Define role-based access controls (RBAC) to ensure data privacy and compliance.

- Choose the most suitable tech stack (React.js, Node.js, PostgreSQL, AWS, etc.).

3️. Agile Development & Integration

Frontend Development:

- Develop a responsive and intuitive UI for seamless user experience.

- Implement self-service dashboards for claim tracking, premium payments, and policy updates.

Backend Development:

- Build secure and scalable APIs for smooth data communication.

- Implement automated approval workflows for faster processing.

- Develop notification & alert systems (email, SMS, push notifications).

Third-Party Integrations:

- Payment gateways (Stripe, PayPal) for secure online transactions.

- CRM & ERP integration for real-time data synchronization.

- Identity management systems (Okta, Auth0) for secure authentication.

Security & Compliance:

- Implement data encryption, role-based access, and audit logs.

- Ensure compliance with HIPAA, GDPR, and local healthcare regulations.

4️. Testing & Quality Assurance (QA)

- Functional Testing – Validate claims submission, premium payments, policy management, and approvals.

- Security Testing – Perform penetration testing, vulnerability assessment, and data encryption checks.

- Performance Testing – Ensure scalability and load-handling capacity.

- User Acceptance Testing (UAT) – Conduct end-user testing sessions with key stakeholders.

5️. Deployment & User Training

- Deploy the portal on a secure cloud environment (AWS/Azure/GCP).

- Implement automated backups and disaster recovery measures.

- Conduct training sessions for staff and policyholders.

- Create user manuals, video tutorials, and FAQs for self-guided learning.

6️. Post-Launch Support & Continuous Improvements

- 24/7 Monitoring & Support – Ensure smooth operations post-launch.

- Bug Fixes & Performance Optimization – Regular updates for stability.

- Feature Enhancements – Implement feedback-driven improvements.

- Analytics & Insights – Provide real-time reports on claim trends, premium payment patterns, and user engagement.

Teams Involved & Client Collaboration

To ensure the successful execution of this project, we assembled a multidisciplinary team at 42Signs Infosystems:

- Project Management Team: Led agile sprints, stakeholder communications, and project timelines.

- UI/UX Designers: Created intuitive, user-friendly wireframes and prototypes.

- Frontend Developers: Built the customer-facing interface using React.js and responsive frameworks.

- Backend Developers: Developed scalable APIs and automated workflows using Node.js and PostgreSQL.

- Security & Compliance Experts: Ensured compliance with healthcare regulations and data security.

- Quality Assurance (QA) Team: Conducted rigorous testing to ensure reliability and performance.

- DevOps Engineers: Managed cloud deployment, backups, and continuous integration/delivery.

Our approach emphasized close collaboration with the client through:

- Interactive Workshops: Engaged stakeholders in requirement gathering, wireframe validation, and prototype testing.

- Weekly Agile Sprints: Provided incremental updates, allowing flexibility and real-time feedback.

- Live Demos & User Training: Ensured smooth adoption with hands-on training for internal teams and policyholders.

Technology Stack

Frontend (User Interface):

- React.js / Angular / Vue.js – For a modern, responsive, and interactive user experience.

- HTML5, CSS3, JavaScript (ES6+), Tailwind CSS / Bootstrap – For structured and responsive UI design.

Backend (Server & API Development):

- Node.js with Express.js – For a scalable, event-driven backend.

- Python with Django / Flask – If a more data-centric or AI-driven backend is needed.

- Ruby on Rails – For rapid development if required.

Database (Data Storage & Management):

- PostgreSQL / MySQL – For structured relational data.

- MongoDB – For flexible NoSQL storage (if required).

- Redis – For caching and improving application speed.

Authentication & Security:

- OAuth 2.0 / JWT (JSON Web Tokens) – Secure authentication for users.

- Okta / Auth0 / Firebase Authentication – For seamless login and user management.

- SSL/TLS Encryption – Ensuring secure data transmission.

Key Outcomes Achieved:

- 30% Faster Claims Processing – Customers can submit and track claims in real time.

- 20% Increase in Timely Premium Payments – Automated invoices and payment reminders reduced delays.

- 40% Fewer Customer Inquiries – Self-service access to claims, invoices, and policies reduced support dependency.

- 50% Faster Approval Process – Automated workflows streamlined internal decision-making.

- Scalability for Future Growth – The cloud-based solution supports business expansion effortlessly.

Conclusion

The development and implementation of the customer portal have significantly transformed the healthcare insurance provider’s operations, addressing key pain points and improving overall efficiency. By digitizing claims management, premium processing, policy tracking, approvals, and notifications, the provider has successfully enhanced customer experience while streamlining internal workflows.

Looking Ahead

As the healthcare insurance industry continues to evolve, digital transformation is no longer optional—it’s essential. With this customer portal, the provider has taken a significant step toward operational efficiency and digital innovation. Future enhancements, such as AI-driven analytics, chatbot support, and mobile app integration, can further improve engagement and service delivery.

At 42Signs Infosystems, we specialize in custom digital solutions that drive business success. If you’re looking to streamline operations, enhance customer experience, and future-proof your business, let’s connect and discuss how we can help you achieve your digital transformation goals.